Neither the corporation nor any of its shareholders was notified by the IRS of any problems regarding the S corporation status within 6 months of the date on which the Form 1120S for the first year was timely filed and. At least 6 months has elapsed since the date on which the corporation filed its tax return for the first year the corporation intended to be an S corporation. The corporation and all its shareholders reported their income consistent with S corporation status for the year the S election should have been made and for every subsequent taxable year (if any). The entity failed to qualify as an S corporation solely because the election was not timely field. The entity is a corporation (i.e., not an LLC seeking an entity classification election). Exception to the 3 Years and 75 Days RuleĬertain entities can qualify for the exception to the 3 years and 75 day rule when: If the entity does not qualify under the provisions of the Revenue Procedure, its only recourse is to request a private letter ruling. 2013-30, the Campus can grant late election relief. If the entity qualifies and files timely in accordance with Rev. The entity timely filed all required federal tax returns consistent with its requested classification as an S corporation. The entity failed to qualify as a corporation solely because Form 8832 was not timely filed and. The entity is an eligible entity as defined in Treas. In addition, if the electing entity is requesting a late corporate classification election to be effective on the same date that the S corporation election was intended to be effective, the requesting entity must also meet the following additional requirements: Less than 3 years and 75 days have passed since the effective date of the election (See the Exception to the 3 Years and 75 Day Rule section below). The entity and all shareholders reported their income consistent with an S corporation election in effect for the year the election should have been made and all subsequent years and. The entity has reasonable cause for its failure to make the election timely. The entity intended to be classified as an S corporation, is an eligible entity, and failed to qualify as an S corporation solely because the election was not timely. The following requirements must be met to qualify for late S corporation election relief by a corporation or entity classified as a corporation: General Relief Rules for S Corporation Elections However, for certain inadvertent invalid S corporation elections or QSub elections, relief may be obtained from National Office under IRC § 1362(f). Also, if there was an invalid shareholder or the corporation was not qualified during any part of the tax year, the S election is not valid for that year. For example, the S election must still contain signatures from all the shareholders. 2013-30 relief is only for late elections that would otherwise be valid. 2021-1 PDF) (or its successor).Īgain, it is important to know that Rev. The procedural requirements for requesting a letter ruling and the associated fees are described in Rev. 2013-30, the entity may request relief by requesting a private letter ruling. If an entity does not qualify for relief under Rev.

Neither the corporation nor any of its shareholders was notified by the IRS of any problems regarding the S corporation status within 6 months of the date on which the Form 1120S for the first year was timely filed and. At least 6 months has elapsed since the date on which the corporation filed its tax return for the first year the corporation intended to be an S corporation. The corporation and all its shareholders reported their income consistent with S corporation status for the year the S election should have been made and for every subsequent taxable year (if any). The entity failed to qualify as an S corporation solely because the election was not timely field. The entity is a corporation (i.e., not an LLC seeking an entity classification election). Exception to the 3 Years and 75 Days RuleĬertain entities can qualify for the exception to the 3 years and 75 day rule when: If the entity does not qualify under the provisions of the Revenue Procedure, its only recourse is to request a private letter ruling. 2013-30, the Campus can grant late election relief. If the entity qualifies and files timely in accordance with Rev. The entity timely filed all required federal tax returns consistent with its requested classification as an S corporation. The entity failed to qualify as a corporation solely because Form 8832 was not timely filed and. The entity is an eligible entity as defined in Treas. In addition, if the electing entity is requesting a late corporate classification election to be effective on the same date that the S corporation election was intended to be effective, the requesting entity must also meet the following additional requirements: Less than 3 years and 75 days have passed since the effective date of the election (See the Exception to the 3 Years and 75 Day Rule section below). The entity and all shareholders reported their income consistent with an S corporation election in effect for the year the election should have been made and all subsequent years and. The entity has reasonable cause for its failure to make the election timely. The entity intended to be classified as an S corporation, is an eligible entity, and failed to qualify as an S corporation solely because the election was not timely. The following requirements must be met to qualify for late S corporation election relief by a corporation or entity classified as a corporation: General Relief Rules for S Corporation Elections However, for certain inadvertent invalid S corporation elections or QSub elections, relief may be obtained from National Office under IRC § 1362(f). Also, if there was an invalid shareholder or the corporation was not qualified during any part of the tax year, the S election is not valid for that year. For example, the S election must still contain signatures from all the shareholders. 2013-30 relief is only for late elections that would otherwise be valid. 2021-1 PDF) (or its successor).Īgain, it is important to know that Rev. The procedural requirements for requesting a letter ruling and the associated fees are described in Rev. 2013-30, the entity may request relief by requesting a private letter ruling. If an entity does not qualify for relief under Rev.

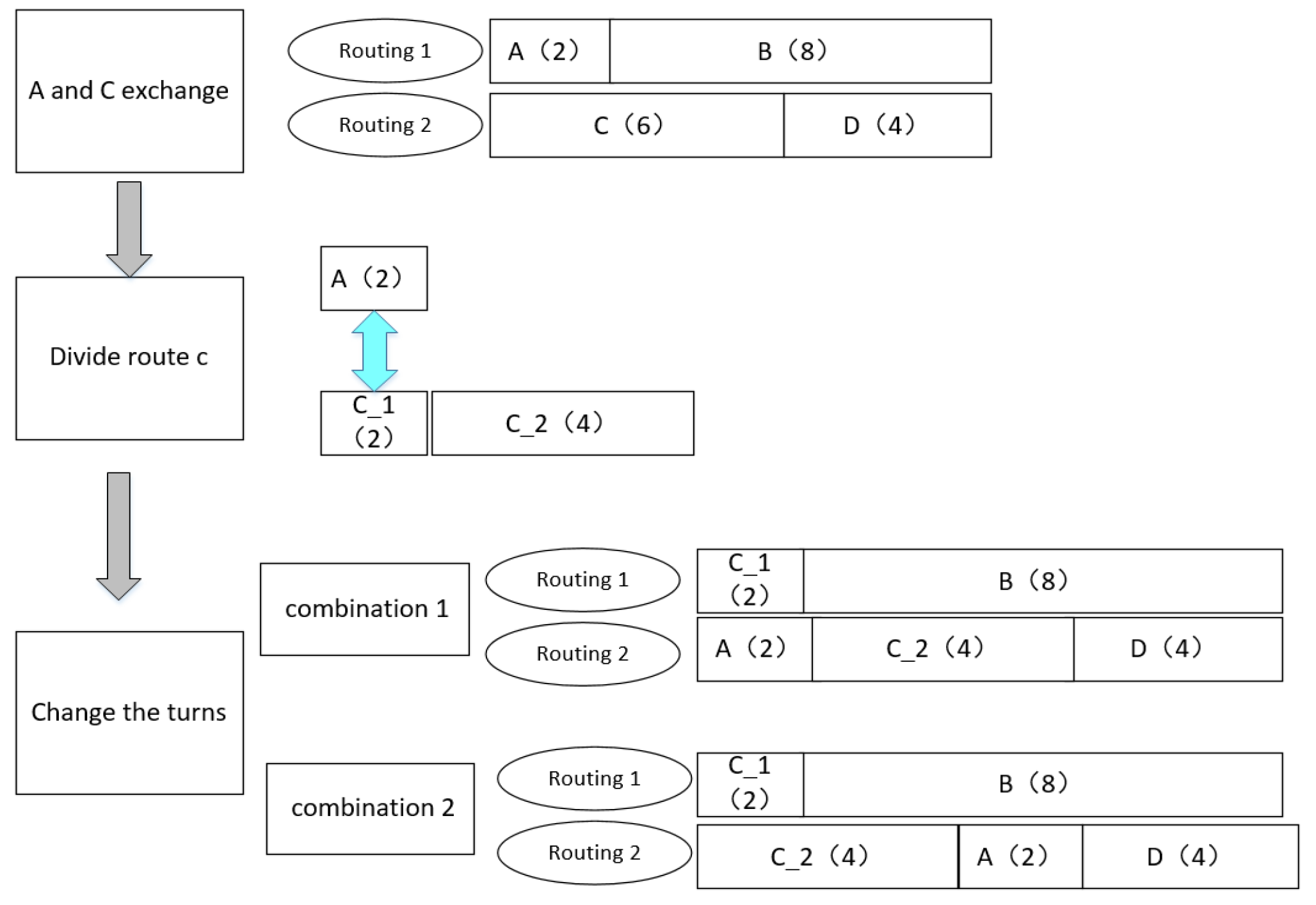

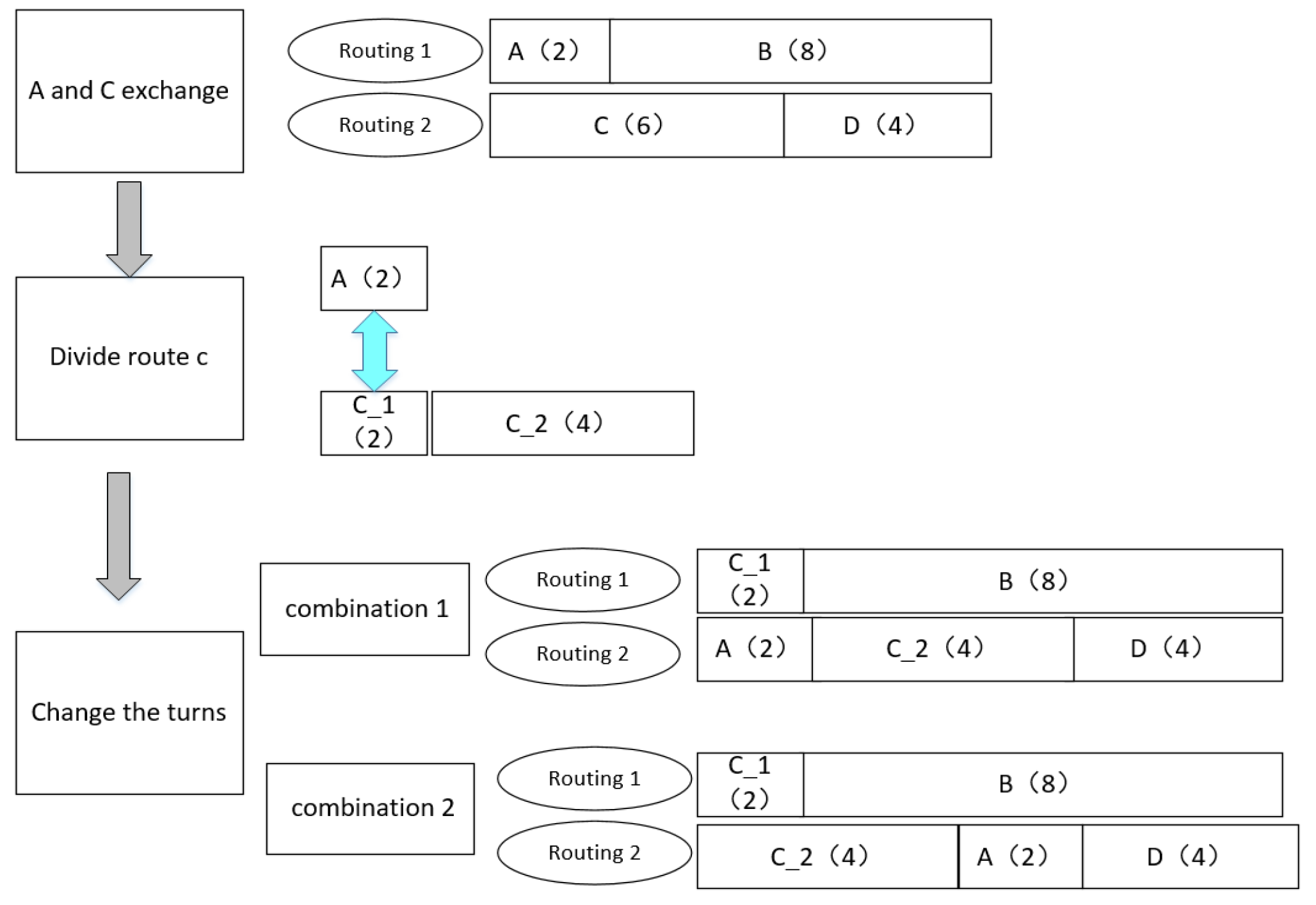

2013-30 includes flow charts, as well as specific guidance for each of the five categories listed above. To assist in determining if an entity qualifies for late election relief, Rev. For purposes of this guidance, the “effective date” is the date the election is intended to be effective and cannot be more than 3 years and 75 days from the date relief is requested.

Generally, the relief under the revenue procedure can be granted when the entity fails to qualify solely because it failed to file the appropriate election under Subchapter S timely with the applicable IRS Campus and all returns reported income consistently as if the election was in effect. Corporate classification elections which the entity intended to take effect on the same date that the S corporation election would take effect.Qualified Subchapter S Subsidiary (QSub) elections, and.Qualified Subchapter S Trust (QSST) elections,.Electing Small Business Trust (ESBT) elections,.This procedure provides guidance for relief for late: 2013-30 facilitates the grant of relief to late-filing entities by consolidating numerous other revenue procedures into one revenue procedure and extending relief in certain circumstances.

0 kommentar(er)

0 kommentar(er)